Everything about the booklet has

Sommaire

- 0.1 Holder

- 0.2 Duration

- 0.3 Current compensation

- 0.4 Taxation

- 0.5 Availability

- 0.6 Payments and withdrawals

- 0.7 Statements of account

- 0.8 FAQ

- 0.8.1 Who can open a Livret A?

- 0.8.2 If I'm underage?

- 0.8.3 Why the Livret A, initially restricted to 3 establishments, now opens to competition?

- 0.8.4 can we have several livreta?

- 0.8.5 Is it sometimes possible to hold a livret A and a blue booklet of Crédit mutuel?

- 0.8.6 Can we open a livret A in joint account?

- 0.8.7 How does the Livret A?

- 0.8.8 Can a booklet be supplied other than cash way?

- 0.8.9 How does biweekly earnings?

- 0.8.10 What is a "payment limit"?

- 0.8.11 What is RIB RICE RIP?

- 0.8.12 Can we have a RIB on a libretto by a.?

- 0.8.13 Can we have a map with?

- 0.8.14 Transfers with A libretto.

- 0.8.15 Levies on a libretto by a.

- 0.8.16 Where is my money really?

- 0.8.17 Utility:

- 0.9 Regulatory text:

- 1 Wikipedia definition

- 1.1 History

- 1.2 Characteristics of the livret a.

- 1.3 Collection and use of funds of the livret A

- 1.4 Historical rates and ceilings

- 1.5 Livret A, other booklets and term accounts

- 1.6 Reviews

- 1.7 Notes and references

- 1.8 See also

Holder

- Any person, regardless of its monetary and fiscal situation.

- Each Member of the family, whatever his age. Opening a Livret A to a minor child is made by the legal representative. It is also recognized that a minor could open a Livret A without the intervention of his legal representative.

- Certain legal entities (associations 1901, condominium for example; in this case the ceiling is 76 500 EUR)

- No joint account opening.

- A single booklet has per person.

Open an account boursorama

Duration

Current compensation

- 0.75 %(1) net per year.

- The rate of the Livret A is fixed by the public authorities. It can be changed 4 times per year.

- The interest is calculated per period of 15 days, under the rule of Fortnights (1-15) and from 16 to 30 of each month and credited to your Livret A at the beginning of the month of January of the following year.

Taxation

Availability

Payments and withdrawals

- Payment to the opening: minimum EUR 10.

- Free payment: minimum EUR 10.

- Regular payment: minimum EUR 15 per month in general society for example

- Possible payments by cash, bank checks, ad hoc or regular transfers from your account.

- Ceiling of payment: 22 950 EUR excluding interest capitalized since January 1, 2013. This ceiling may be exceeded only by the single annual capitalisation of interest entry. The ceiling is different for associations. It amounts to €76 500.

- Free withdrawal: minimum EUR 10.

- Possible withdrawals:

- cash to the agency holding the Livret A.

- by debit card Generation by Société Générale for 12-18 year olds in ATM's Société Générale and Credit the North or map of withdrawal on libretto for the major clients in ATM's Caisse Flash of Société Générale,.

- by one-time transfers to your account;

- by monthly deductions for the payment of tax on income at the initiative of the Public Treasury.

- Minimum to retain balance: EUR 0.

- From 16 years, you can withdraw the amounts shown on your booklet has, except opposition of your representative legal.

Statements of account

- A monthly statement is sent to you once your account has worked in the past month.

- A record is systematically sent to you in January.

FAQ

Who can open a Livret A?

Any natural person may open a Livret A, regardless of its financial and tax situation. It must not, however already hold a Livret A or Livret blue. Each Member of the family, regardless of age, can open a. Opening a Livret A to a minor child is carried out by the legal representative, but it is also recognized that a minor could open a Livret A without the intervention of his legal representative.

You can open a Livret A in a different bank from your bank account.

not subject to the corporate income tax, moderate rent housing agencies and condominium associations open a livret A.

If I'm underage?

Minors may remove, without permission of their representative legal, the amounts listed on their books, but only from the age of sixteen years of age unless their representative legal. A minor can open only a livret A. However before his 16 years, this is his legal representative who will set rules of operation.

Why the Livret A, initially restricted to 3 establishments, now opens to competition?

The distribution of the Livret A has been entrusted exclusively to three institutions with a social vocation (the savings bank, La Banque Postale and Crédit Mutuel) in respect of the mission "of general interest". However they are now full-fledged banks. This privilege has been questioned by competing banks and the European Commission, who denounced an impediment to competition. July 23, 2008, the generalization of the booklet has all the credit institution was passed under the law of modernization of the economy. Marketing began January 1, 2009. The distribution of the Livret A is thus extended to all banks licensed in France (including branches of foreign banks).

can we have several livreta?

The same person may hold that a single booklet has. The detention of a second booklet may give rise to a fine of 2% of the outstanding amount of the second. Since January 1, 2013, any institution an application for opening a savings A, must notify the client of the regulation prohibiting have several livrets A and the functioning of the control procedure prior to opening a livret A. Since this date, it is impossible to open a livret A to a person who already holds a such booklet to another banking institution. Since January 1, 2013, any institution an application for opening a booklet shall notify the client of the rules prohibiting having several livrets A and the functioning of the control procedure prior to opening a livret A.

The establishment before a logon request shall prior to questioning the tax administration on the possible existence of a previous booklet.

Is it sometimes possible to hold a livret A and a blue booklet of Crédit mutuel?

Persons having opened a special account on the Crédit mutuel livret before 1 January 1979 may also hold a livret A.

Can we open a livret A in joint account?

It is not possible to open a livret A joint account or group account.

How does the Livret A?

Payments are free from 10 EUR and can be made in cash, by cheque or by transfer.

Can a booklet be supplied other than cash way?

How does biweekly earnings?

What is a "payment limit"?

What is RIB RICE RIP?

Can we have a RIB on a libretto by a.?

Can we have a map with?

Transfers with A libretto.

Levies on a libretto by a.

The Ministry of economy issued several orders on December 4, 2008 (OJ of 5 December 2008) to clarify and reiterate the conditions of operation of the Livret A, available since January 1, 2008 in all financial institutions.

Transfers

Can be transferred on A booklet:

- the social benefits paid by public authorities and the social security agencies;

- the pensions of public officials;

Levies

Can be directly taken from A booklet:

- the income tax,

- the housing tax,

- property taxes

- the licence fee;

- waivers of water, gas or electricity;

- rents due to moderate rental housing agencies.

Each credit institution distributor of the precise livreta, in its general conditions of marketing of the book, those operations on the list authorized licensees to a libretto opened in its accounts.

It is therefore bine your bank who decides…

Where is my money really?

Funds invested on the livret A are currently centralized 65 percent on a savings fund that belongs to the State and which is managed by the Caisse des depots; the remaining 35% are held by banks. The share of the collection preserved by banks must be used for the financing of small and medium-sized enterprises, as well as the financing of the work of energy saving in old buildings.

Utility:

L´argent have available without fear l´inflation, ideally 3-6 months of charges. This is not an investment to earn l´argent

Regulatory text:

-

Monetary and financial code: articles L221-1 to L221-9

Libretto by a.

-

Monetary and financial code: articles R221-1 to R221-7

Operation of the livret a.

-

Monetary and financial code: articles R221-121 to R221-126

Checks at the opening of a libretto by a.

-

General tax code: section 1739

Fine in the event of opening more of a booklet has per person

-

Decree n ° 65-1158 of December 24, 1965 on the savings scheme

-

Order of October 31, 2012 for prior audits at the opening of a libretto by a.

-

Order of 25 January 2016 on the rates of interest of regulated savings products

Wikipedia definition

History

The livret A (formerly savings bank book or booklet series A) is created on 22 may 1818, concomitantly to the Caisse d'Epargne in Paris, at the initiative of Benjamin Delessert, who was industrial and banker. The Presidency of this new institution will be quickly entrusted to Duke François Alexandre Frédéric de La Rochefoucauld – Liancourt3.

Its creation by Louis XVIII motivations were to settle the financial crisis bequeathed by the Napoleonic wars. According to Georges Constantin, during this period, the State has squandered public savings, as sienne3.

In the course of the 19th century, the libretto A was also a willingness to initiate, in the perspective of welfare, working populations to the gesture of the deposit in the Bank, at a time where don't exist nor social protection system or accessible to the largest nombre4 savings as.

Characteristics of the livret a.

- A single book per person, major or minor. However, simultaneous possession of a booklet and a blue open book both prior to September 1, 1979 (date of entry into force of Decree No. 79-730, August 30, 1979, which has removed this faculty) remains possible. This provision has not been questioned by Act No. 2008-776 of August 4, 2008, to modernize the economy. Updated August 11, 2010, it is possible for individuals who held a livret A (open to the post office or the savings) and a libretto blue open to Crédit mutuel keep (without transferring) these two livrets5, 6.

- Payment to the opening minimum: €10 (€1.5 for a libretto to La Banque postale) 5

- Monthly payment: not applicable (free payments),

Ceiling of deposits

The ceiling of deposits for natural persons is €22 950 (article R. 221 – 2 Code monetary and financial) since 1 January 20135,7. Partially in response to a promise to campagne8, the Government of the Presidency of François Holland successively brought the initial ceiling of €15 300, previous ceiling since 1986, to €19 125 October 1, 2012 and €22 950 on 1 January 20139, an increase of 50%. If the latter had evolved with inflation since 1986, it would have been brought to more than €25 500 in September 2012.[réf. souhaitée]

The ceiling of deposits for mutual and cooperation institutions, charities and other similar societies (associations Act 1901) is €76 500 (article R. 221 – 2 of the monetary and financial Code) 5.

The ceiling of deposits for moderate rent housing and real estate credit agencies: none (unlimited deposit) (article R. 221 – 9 of the monetary and financial Code)[réf. souhaitée].

Article L221-1 of the monetary and financial Code does not explicitly prohibit the opening of a libretto by a. corporations (LLC, SCI) within the limit of the ceiling of right common (€19 125). Indeed this article only provides that the booklets are nominative and the same "person" can be holder of a single booklet or blue. The 'person' can be physical or moral. In the case of legal persons, associations and bodies HLM enjoys a higher deposit limit, which prohibits nor the application of the ceiling of law, common to other legal persons. However, in practice, financial institutions refuse the creation of a booklet to the SARL and SCI. In fact, the project of modernization of the economy, in the version of April 28, 2008, article 39, proposes to amend article L. 221 – 3 of the monetary and financial Code as follows: "the livret A is open to individuals, to associations mentioned in 5. Article 206 of the general code of taxes and moderate rent housing agencies.

Once the ceiling reached, can no longer proceed to additional payments until a withdrawal was not made in advance; only the interest may continue to credit the account above the limit. The interest calculation is done on the lump sum, even after exceeding ceiling; Thus, a livret A with €23,000 relate, at the rate of 1% to €230 (€23,000 base) and not €229.5 (base of €22 950, the maximum payments amount to 1 January 2013).

Interest rate

The nominal interest rate is 0.75% for net since August 1 201510.

Interest shall be calculated in accordance with the rule of the Fortnights (twice per month 1 and 16). The interest is exempt from all taxes and dues sociales5.

Force majeure, a decree in Council of State on the report of the Minister of the economy and the Minister responsible for the post office may limit reimbursements by half to 2% of the maximum allowed of deposition on the A11 booklet.

To close a libretto, it must make a request in writing or in person at the Bank that manages the libretto, attach a RIB of the account on which transfer money from the booklet has, and the closing is done in days.5 15, 12.

The booklet has being a regulated savings product, the limit values and nominal interest rate can be modified by decision of the Government. Thus, the possible updating of the nominal interest rate occurs according to a biannual rhythm, August 1 and February 1 of each year.

The livret A in figures

The livret A is placing the most popular savings with the French with 60 million booklets in August 2010 as a result of the opening of the placement to all sectors13.

Before the opening of this booklet was reserved for institutions of the post and the Caisse d'Epargne, Crédit mutuel with an equivalent with the blue booklet. In 2008 there were nearly 46 million livrets A open, which represents about three French on quatre14. However, the Bank and similar accounts (FICOBA) file mentioned the figure of 37 million persons, which would amount to three French on cinq15. The difference of 9 million is attributable to the multi-detenteurs (which is forbidden by the law, except books opened before 1980), to legal persons not identified by FICOBA such as associations, social organizations of Habitat, etc.

In 4 years, thanks to the financial crisis of 2008 and the increase of the ceiling of the livret A from 2012, the collection would have evolved 85 Md€ (between December 2008 and December 2012), bringing the total outstanding to 250 Md€, an average of about 5,000 euros per livret2.

The collection grew mainly by the contribution of the richest French following the raising of the plafond16.

The cost of the tax exemption of the livret A was EUR 300 million in 201216.

End of 2012 the number of booklets that the balance is less than €1,500 accounted for 64.2% of the total of the booklets. Only 2.3% of the livret A were credited with a balance greater than the plafond16.

Calculation of interest

A passbook or savings account interest are calculated per fortnight. A calendar year is made up of 24 Fortnights (approximately 15.2 days per fortnight), because the rule used each month has two fortnights, beginning the 1st and 16th of each month. Interests are therefore calculated twice by months5.

The calculation is simple, since it is sufficient to multiply the rate of the booklet by the balance of the booklet. As the rate is annual and interests are not capitalized during the year, should divide this rate by 24 to calculate the interest generated in a half.

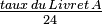

Thus the formula is: interest of fifteen = balance of the × booklet

Deposits for fifteen interest over the following period, that is their value date is the first day of the fortnight following (1st of the following month for the second half of the month, or 16 of the current month for the first two weeks) 5. Conversely, any withdrawal is considered to have been made at the beginning of the fortnight in question (its value date is the first day of the current fortnight). Therefore, the interests that could run the half up to the date of withdrawal are not counted. The balance of the book to be considered for the calculation of interest must therefore take account of these value dates.

If several deposits and withdrawals are carried out successively during the same fortnight, the concerned balance may therefore be lower than the minimum balance in the account during the fortnight (calculated without taking into account the dates of value). This is illustrated by the following case:

| Operation | Date operation | Value date | Credit | Flow | Balance |

|---|---|---|---|---|---|

| Initial balance | 01 jan | 01 jan | 2 300 | ||

| Deposit | 03 jan | 16 jan | 200 | 2 500 | |

| Withdrawal | 05 jan | 01 jan | 500 | 2 000 | |

| Deposit | 08 jan | 16 jan | 100 | 2 100 | |

| Withdrawal | 10 jan | 01 jan | 400 | 1 700 |

In this table, the last column corresponds to the balance on the day the day, without taking account of the value dates.

The balance taken into account for the calculation of interest income during this fortnight is not the initial 2300 balance or the minimum of 1,700 balance, but balance at January 1 calculated using value dates, i.e. 2 300 – 500 – 400 = 1 400. Thus, with a fictitious annual rate at 2%, this booklet will generate 1 400 / 24 × 0, 02 = 1, €17 of interest during the first two weeks of January. These interests are however capitalized to January 1 of the following year, and thus themselves productive interests at this time there.

If no movement is made on the libretto during the next fortnight (from 16 to 31 January), the balance taken into account for the calculation of the interest earned during this fortnight will be the balance on January 16, i.e. €1,700. Thus, with a fictitious annual rate at 2%, this booklet comes to generate 1 700 / 24 × 0, 02 = 1, €42 interest during the second fortnight of January. These interests are however capitalized to January 1 of the following year, and thus themselves productive interests at this time there.

If for a fortnight the balance of the libretto based on the dates of value is negative (which can happen, although the balance of the livret A, calculated using the dates of operation, cannot be negative), it gets a negative interest for the fortnight. At the end of the year, every fortnight negative or positive interests are added, and if this amount, referred to as interest earned, is positive, it is added to the booklet on 1 January of the following year. If it is negative or zero, vested interests are reduced to zero (vested interests can never be negative on a savings product). By the set of dates of values, it is therefore possible to have interests acquired zero for a year, even if the balance of the book has always been strictly positif17.

In order to maximize the amount of interest, and in particular avoid generating negative interest on fifteen, therefore do not perform operations in the opposite direction during the same fortnight.

Collection and use of funds of the livret A

Complex system with several actors

Historically, the State has always hoped that the livret A collection is secure, that is sheltered from financial crises. Without this security, it would be possible to attend the bankruptcy of many savers, if for example the Bank which was entrusted with the money of the livret A should go bankrupt or the french State to fail.

For many years, these funds were therefore collected by the distributing networks and centralized at the Caisse des Dépôts et consignations, within a Directorate called savings, independent accounting. This distinction allows do not "mix" money from the Caisse des dépôts issue of business propres18, 19 and that of its mandates (with booklet).

This centralization is the subject of a commission paid by the Caisse des dépôts at collection systems.

The Caisse des dépôts then uses these funds to finance missions of general interest, and particularly social housing (HLM).

This mechanism is still topical despite the profound revision of its terms, established by the law of modernization of the economy of the Fillon Government in 2008.

Distribution and collection of the livret a.

Since its creation in 1818 and until December 31, 2008, the livret A will have been distributed by two types of institutions:

- From the origin by savings newly created;

- For the years 1875-1879 by the different post offices in the title of the national savings bank, absorbed in 1990 by what would become the Postal Bank.

Crédit mutuel distributes Meanwhile a "blue booklet" with almost identical characteristics (blue booklet is endorsed, but it is the Caisse des dépôts centralizing this resource which recognises in its result the contested levy, which has no impact for the investor[réf. souhaitée]).

This causes tension on the part of the other networks of banks which cannot distribute it and speak of distortion of competition. Whereas this system constitutes an obstacle to freedom of establishment and the free provision of services offered to all banks in the European market, the European Commission asked may 10, 2007 at the France open these products to competition within a period of 9 months.

The distribution of the livret A is in June 2008 discussed in Parliament, and it is open to all banking institutions since January 1, 2009. April 12, 2009, Credit Agricole announced they intend to continue the savings for "barriers to transfers of the livreta.[réf. souhaitée]

Centralization of funds to the Caisse des dépôts

Before January 1, 2009

For many years, all the funds livret A and blue collected by the distributing networks was totally centralized, the Caisse des Dépôts et consignations.

The rate of commissioning served by the Caisse des dépôts reached in 2007 the average of 1.12 %20:

- 1.3% for the Postal Bank;

- 1 percent for savings;

- 1.1% for Crédit mutuel (excluding tax).

Since January 1, 2009

The law on the modernisation of the economy entering into force on January 1, 2009 has, in trivialising the distribution, introduced new rules centralization and commissioning of the distributing networks.

Fluctuating centralization needs

Banking institutions are required to centralize approximately 65% of the stock of the livret A and LDD with the depots21 Fund. This rate is however facing a legislative floor, which provides that the centralization of funds should at least be equal to 1.25 times the amount of the loans granted by the Caisse des dépôts social housing and the ville22 policy.

This rate of centralization can be subject to regulatory amendments, after consultation with the Commission's monitoring of the Caisse des dépôts. Thus, in July 2013, stakeholders agreed on a reduction of 20 Md€ centralized funds, in Exchange for a decrease in the rate of commissioning of collection systems of 0.1% 21.

To allow adaptation of banking institutions to the new modalities of centralization, a transitional regime introduced by the law of modernization of the economy (LME) (IV of article 146). The terms of this plan are specified by Decree No. 2011-275, modifie23, March 16, 2011.

Commissioning homogenized term

In respect of the distribution of the livret A, banks receive a commissioning, which rises since July 2013 to 0.4% 24 declining regular since law LME (0.6% in 2008).

To enable historical networks to adapt to the new competitive environment, the rate of commissioning served to the latter by the Caisse des depots will be gradually decreased, so that it reaches the horizon of 2022 rate commun23.

The Postal Bank will benefit as a special status. Ensuring banking accessibility mission, it will benefit from a surcommissionnement remaining to be defined on the basis of the actual cost of this mission25.

Use of centralized funding to the Caisse des dépôts

The livret A allows primarily to finance social housing: the Caisse des dépôts ready social organizations of habitat (OPAC, public offices of habitat (OPH), business social of habitat (ESH ex-SA HLM)…) of funds indexed on livret A at privileged rates. For example, the rate of the rental loan for social use (more) is at August 1, 2009 equal to 1.85%, or book A + 0.6% 26. In late 2007, the savings (excluding refinancing) lend 88 Md€ (funds booklet has, but also LDD, LEP…, in financing used of:)

- Capital projects: 3 Md€

- Housing programs: Md €84, including:

- Very social: 4 Md€

- Rental: 47 Md€

- home improvement: 5 Md€

- rental intermediates: 6 Md€

- urban projects: 2 Md€

- urban renewal: 4 Md€

- Various projects: 1 billion€

Financial investments

The booklet has resource costs to the Caisse des dépôts averaged the rate of the livret A + 1.12% 20, in August 2008 the rate of 5.12% (4% + 1.12%). The lending rates are lower than the cost of the resource, it follows a bilanciel imbalance that does not allow savings funds to lend the whole resource booklet: a certain amount must be wisely invested on the financial markets to clear a higher profitability, while maintaining a controlled risk.

In late 2007, the portfolio of 114 Md€ decomposed as:

- Actions: 11 Md€

- Bonds: 67 Md€, including:

- inflation (OATi): 20 Md€

- fixed > 5 years: 8 Md€

- fixed rate of 2 to 5 years: 10 Md€

- fixed rates from 6 months to 2 years: 29 Md€

- Short term and related occupations (Euribor 3 months, for example): 36 Md€

Historical rates and ceilings

History of nominal interest rates

| Date | Taux3, 27, 28 |

|---|---|

| 5.00% | |

| 4.75% | |

| 3.50% | |

| 3.00% | |

| 3.50% | |

| 3.50% | |

| 1.50% | |

| 3.25% | |

| 3.00% | |

| 3.50% | |

| 4.00% | |

| 4.25% | |

| 6.00% | |

| 7.50% | |

| 6.50% | |

| 8.50% | |

| 7.50% | |

| 6.50% | |

| 6.00% | |

| 4.50% | |

| 3.50% | |

| 3.00% | |

| 2.25% | |

| 3.00% | |

| 2.25% | |

| 2.00% | |

| 2.25% | |

| 2.75% | |

| 3.00% | |

| 3.50% | |

| 4.00% | |

| 2.50% | |

| 1.75% | |

| 1.25% | |

| 1.75% | |

| 2.00% | |

| 2.25% | |

| 1.75% | |

| 1.25% | |

| 1.00 29 | |

| 0.75% |

History of ceilings

| Date | Ceiling (F) 30 | Ceiling (€) | Purchasing power (€ 2014) 31 |

|---|---|---|---|

| 2 000 (former) F 32 | €3.05 | €234 33 | |

| 15 000 F | €2 287 | €20 911 | |

| 20 000 F | €3 049 | €22 407 | |

| 22 500 F | €3 430 | €19 555 | |

| 25 000 F | €3 811 | €19 106 | |

| 32 500 F | €4 955 | €20 273 | |

| 38 000 F | €5 793 | €21 673 | |

| 41 000 F | €6 250 | €21 441 | |

| 45 000 F | €6 860 | €21 247 | |

| 49 000 F | €7 470 | €20 374 | |

| 58 000 F | €8 842 | €17 349 | |

| 68 000 F | €10 367 | €18 937 | |

| 72 000 F | €10 976 | €18 456 | |

| 80 000 F | €12 196 | €19 882 | |

| 90 000 F | €13 720 | €20 337 | |

| 100 000 F | €15 245 | €21 895 | |

| 100 361 F | €15 300 | €18 471 | |

| 125 452 F | €19 125 | €19 387 | |

| 150 542 F | €22 950 | €23 065 |

Nominal interest rate

The Government of Jean-Pierre Raffarin had decide34 to set up an automatic calculation of the nominal interest rate formula, in order to avoid the intervention of political decisions. The latter was indeed determined in its discretion by the Government in place.

The rate of the livret A conditioned by elsewhere that other regulated savings products: popular savings, libretto by sustainable development, housing, young booklet savings account and blue booklet (distributed by Crédit mutuel until December 2008) mainly.

Rate before February 2008

The and until end of January 2008, the livret A rate set by an automatic formula calculated based on two indicators:

- the average Euribor 3 month monthly rate for month m-1 (respectively December and June) 35, expressed to two decimal places;

- the annual rolling inflation rate, given by the index INSEE of the consumer prices excluding tobacco for month m-1 (respectively December and June) 35, expressed to one decimal place.

The found result is increased by 0.25% and rounded up to the nearest 0.25%. This final figure gives the rate of the livret A. This formula allows the Bank of France to propose twice in the year (mid-January and mid-July) the updating of the livret A rate.

Coupon from February 1, 2008

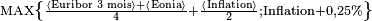

Since February 1, 2008, a new formula for calculating the rate is put into place36. The rate is equal, after rounding to the quarter point nearest or failing in the highest quarter, at the higher between:

- the average arithmetic between, on the one hand, half of the sum of the monthly average of the Euribor 3-month with the monthly average of the Eonia (expressed to two decimal places) and, secondly, inflation in France measured by the variation over the last twelve months known index INSEE of the consumption of all prices off tobacco households (expressed with one decimal place);

- inflation plus a quarter point.

Either:

The data used are those for the last month for which these data are known.

Cases where the formula was not applied

However, this formula was not applied during the revision of the rate of February 1, 2012. Indeed, inflation to remember of the month December 2011 (last known) was 2.4% which would lead to enhance the rate of the livret A at 2.75%. But the Fillon Government decided to maintain this rate to 2.25%.

A year later, while annual 1.2% inflation should have resulted in a rate of 1.50% from February 1, 2013 in the case of the application of the formula, the economy Minister, Pierre Moscovici, decided to lower the rate by half a point to 1.75% 37.

Six months later, while annual inflation should lead to a 1% rate from August 1, 2013, in the case of the application of the formula, the economy Minister, Pierre Moscovici, decided to lower the rate on that half a percentage point to 1.25% 38, which was then its lowest historical rate.

Similarly, to February 1, 2014, while the Governor of the Bank of France advocates to lower the rate to 1% and that the strict application of the formula would lead to lower it to 0.75%, the Minister decides to maintain it at 1.25% 39.

Examples of calculation

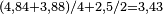

Example of calculation of the nominal interest rate of the livret A (figures for a calculation at February 1, 2008)

- Monthly average of the December Eonia 200740: 0,038761905 (or 3.88%)

- Monthly average of the Euribor 3 month of December 200741: 0,048404286 (or 4.84%)

- Price (CPI), series off tobacco households consumption index, December 200742: 0,025266309 (2.5%)

Rate calculated from the formula up to February 2008:, r ounded to 4%

ounded to 4%

Rate calculated from the formula used since February 2008:, roun ded down to 3.5%

ded down to 3.5%

Recommendations for the calculation of the rate

Report Walnut-Nasse (2003)

The report on the balance of savings funds by Christian Noyer and Philippe Nasse (' report Walnut-Nasse "), January 200318 proposed a formula respecting everyone's interests (savers and borrowers financing missions of general interest, including social housing), by indexing"a little above inflation", but"a little below, short-term interest rates". The recommended formula became: 2/3 of the rate of pay of the deposits of the European Central Bank + 1%, rounded to the nearest 0.25%.

This formula ultimately was unsuccessful.

Camdessus report (2007)

The report of the mission on the modernization of the distribution of the livret A and the circuits of housing finance office of Michel Camdessus ("Camdessus report"), handed over to the Government of François Fillon in December 200719, proposed as a formula for calculating the average arithmetic mean of the Eonia and inflation, according to the rules for calculating deductions from February 1, 2008, with a floor to Inflation + 0.25%.

The Euribor 3-month component eventually was maintained in the new formula, while integrating the Eonia reference.

Livret A, other booklets and term accounts

These three forms of monetary savings, which are not securities but rather savings bank accounts, values have in common their liquidity, even if a term account is subject to structuring or penalties for release anticipe43.

Other booklets were previously answered by traditional banks to the monopoly of the distribution of the livret A. With the trivialization of the distribution (see), the interest of the banks lies in conservation, in their balance sheet, of the funds. Other booklets are available with higher gross (excluding tax), whose net rate (tax deducted) is, depending on market conditions, sometimes higher than the rate of regulated savings.

Term accounts are placed on the financial markets through the Bank or used for its own account. According to durations of placement, proposed rates vary, mainly the Euribor.

In the case of low real interest rates (indicator of competitiveness of the livret A), super booklets crude rates are more than enough high so that once the tax deducted, they can exceed that of the livret A. The arguments put forward are now ceilings higher entitlements and the availability.

Term accounts found in them an audience: booklet rate being anchored by inflation, just that the term account rate significantly higher than this inflation so that its net rate is interesting and no payment ceiling.

Reviews

Certain terms of the livret A are critiquees44, 45, 46, 47:

- The livret A is totally tax-free, including CSG and CRDS. Therefore, certain tax revenues are not perceived by the State or the secu48.

- The livret A has a facialement low, but very high for several years if compared to comparable products (products derived from the money market or bank books). It attracts so many savings, at expense of other products, sometimes over the longer term (such as life insurance).

- The livret A is partly centralized, the Caisse des dépôts (at 65%). Any new increase in the stock livreta deprives the banking establishment of a portion of the savings of his client, while allowing the Caisse des depots to recover for its own missions.

The issues of actors are multiple:

- for the State, it is:

- retain a role of arbitrator enabling a consensus between the issues of the different actors. The wish of the president of the Republic to double the amount of the ceiling of the livret A has partially broken balance that prevailed until now. To the chagrin of Bercy, the France49 Bank or Caisse des depots, which did not identify the objectives pursued by the President.

- do not cut any of its creditors. Indeed, a significant part of the State debt is purchased by the Caisse des depots with the money of the livret A.

- for banks, this is to recover the money of the livret A, to restore its competitiveness, beset by:

- the agreements of Basel III, which imposes additional prudential rules and requires a more consistent liquidity;

- margins on booklet has they consider insufficient (0.5% rate of commissioning for the collection), with regard to its usual generating and less consumers of liquidity (SICAV, FCP, life insurance, etc.).

- the Fund deposits, Manager of the funds of the booklet, mandated by the State, it is:

- ensure that Government arbitration does not call in question its mission of funding;

- preserve the role it provides for nearly a century.

- for the HLM world, ensure that it will benefit from the long-term resources, good markets and available, for its construction business, rehabilitation, development, policy of the city.

- for communities, benefiting from 2013 a multi-year envelope of 20 Md€ 50, to ensure that these funds are well allocated to their account.

- for investors, a net rate high, with the highest ceiling.

Feeling their menaces51 issues (the doubling of the ceiling has "sucked" many of the french savings: 15 Md€ on the only first half of 2013) 52, several bank lobbies have denounced the doubling of the ceiling of the livret A and benefited from this window to challenge the use of the booklet has:

- Philippe Crevel (circle of investors), considers that the money placed on the livret A contributes to the economy or the growth and constitutes a "waste" while there is 'a lack for equity in SMEs that do not invest enough to position themselves in the premium markets' 53.

- The French Banking Federation (FBF) criticizes the use of the funds managed by the Caisse des dépôts. According to her, the funds available for the financing of social housing "are not fully used today" and raising the ceiling of the livret A would prevent banks strengthen their capital before the entry into force of the new regulatory framework of Basel III in 2013. The FBF said that "should be at least to review the rate of centralization at the Caisse des dépôts for allowing banks to retain the means to lend to their clients' 44.

- Financial rating agency Standard & Poors (S & P), in a note published in June 2013, estimated that the livret A is "prejudicial" for French banks because it deprives them of deposition to reinforce their solvency and liquidity ratios, as required by the Basel III regulations. S & P the livreta creates even "a distortion of market', as 'the regulator shall determine the rate of pay of the livret A by using a formula which, in general, positioned above the market rate' 45.46.

The reaction of stakeholders to the challenges opposed to these banking lobbies is essentially based on:

- the inability of banks to prove the use of the funds which they have on their balance sheet, including in terms of business financing, since they are accused since 2009 no longer lend to the PME54, 55.

- criticism of the questioning by Basel III, insider banks due to the crisis of subprimes whose responsibility goes to the banks for part.

Under this situation, the banks, the State and the Caisse des dépôts engaged in negotiations which resulted in July 2013 a56:

- a providing of banking networks of 30 billion euros of resources centralized in savings funds. These resources will enable the banks to pay more for the financing of the economy, primarily for the benefit of small and medium-sized enterprises. The requirements of transparency in the use of these resources will be reviewed on this occasion.

- to reduce the cost of the resource savings funds, including the financing of social housing, banks will lower their rate of 0.5 to 0.4% commission.

Notes and references

- Exit the booklet A paper? [archive]

- Monthly gathering in April 2014 on the livret A and the libretto of sustainable development (LDD[archive])", at www.caissedesdepots.fr, (accessed January 15, 2015).

- c Georges Constantin, the libretto has: A history of people's savings, Caisse des dépôts and consignations (ISBN 2 – 911144-05-8) and La Documentation française (ISBN 2 – 11-004209-5), Paris, 1999, 294 p.

- ↑ Séverine de Coninck, the savings booklet (1818-2008). A French passion, Paris, 2012, Economica, 409 p. (ISBN 9782717864328).

- h ' savings: livret A ",[archive] on service – public.fr,. (accessed January 15, 2015).

- Crédit mutuel blue booklet and application of article L. 221 – 3 of the monetary and financial cod[archive]e.

- Amended by Decree No. 2012-1056 September 18, 2012 followed by Decree No. 2012-1445 December 24, 2012, all two bearing raising the ceiling of the booklet A.

- ↑ Commitment No. 22 candidate François Holland to double the ceiling of the livr[PDF]et A (see 60 commitments[archive]).

- ↑ 'ceiling of the booklet will be list of 25% on January 1, 20[archive]13', http://www.gouvernement.fr[archive]/, (accessed July 17, 2014)

- ↑ "the Livret A rate will fall to 0.75% from August 1", [archive]on lemonde.fr,. (accessed July 20, 2015).

- Article L221-2 of the French Code monétaire et Financie[archive]r.

- ↑ Livret A: characteristic[archive]s, libretto: rate, operation, ceiling.

- ↑ "La France has 60 million livrets A," [archive]on lefigaro.fr, Le Figaro, (accessed January 15, 2015).

- ↑ today in France from August 1, 2008, "the booklet has reported 4% from today', page 6[archive].

- ↑ The echoes of May 5, 2008, "Livret A: hunting in the multi-detention[archive].

- Marc Velez, «the increase of the ceiling of the livret A has benefited the better-of[archive]f!», on lepoint.fr, Le Point,. (accessed January 15, 2015).

- ↑ http://www.ca-nmp.fr/Opt-interets-livrets.html[archive].

- MM. Christian Noyer and Philippe Nasse, «Report on the balance of savings fund[archive]s» (accessed January 15, 2015).

- ubmission of the report on the reform of the distribution of the livret A to the Prime Ministe[archive]r," (accessed January 15, 2015).

- b Les Echos, libretto: commoditization would cost banks EUR 1 billion per year, March 3, 2008.

- b) Decree No. 2013-688 July 30, 2013 on the centralization of the deposits collected in respect of the libretto, of sustainable development and the popular savings booklet

- ↑ Article 221-5 of the monetary and financial Code (legislative part, book II, title II, chapter I, section 1)[archive].

- rticle 5 of Decree No. 2011-275 of March 16, 2011, amended by Decree n ° 2013-688 July 30, 2013 – art. 3 [archive]

- Decree 2011-275, March 16, 2011 amended [archive]

- ↑ Les Echos of May 13, 2008, «La Banque postale will receive compensation for his mission t[archive]o banking accessibility».

- ^ Site of the Ministry of housing thanks to the reform of the livret A, social housing loans rates are lowered on August 1, 2008[archive].

- ↑ History of the rate of the livret A by Société Générale, probably not exhaustive [archive]

- Historical rates of interest on submitexpress.com [archive]

- ^ See the Decree of July 28, 201[archive]4, on the rates mentioned in the rules of the regulatory committee banking No. 86 – 13 of 14 May 1986 concerning the remuneration of the Fund received by credit institutions, NOR FCPT1418017A.

- History of ceilings on submitexpress.com[archive].

- purchasing power of the euro and the S[archive]wiss franc, national Institute of statistics and economic studies, January 2015

- Ceiling of the livre[archive]t A, – investissements.fr, 2012

- ↑ "CPI"%3Bi%3A1%3Bs%3A6%3A"DEFIND"%3Bi%3A2%3Bs%3A4%3A"WAGE"%3Bi%3A3%3Bs%3A5%3A"GDPCP"%3Bi%3A4%3Bs%3A4%3A"GDPC"%3B}&amount=2.34184&year_source=1829&year_result=2015&button=Submit estima[archive]te on measuringworth.com, January 2015

- See the letter of the mission Walnut Nasse [archive]

- ior to September 2005, the m-2 months.

- ↑ Decree of 29 January 2008 amending Regulation No. 86-13 May 14, 1986 amended by CRBF re remuneration of the funds received by credit institutions, published in the OJ on January 31, 2008.

- The remuneration of the livret A well will be lowered to 1.75% in Fe[archive]bruary section of the further published 15/01/2013.

- Livret A: the rate down to 1.25% this Thursday 1 August A[archive]rticle from ComputerWeekly.com published 31/07/2013.

- ↑ Isabelle chaperone, "rate of the booklet will be maintained at 1[archive].25%", Le Monde.fr, (accessed January 15, 2014).

- ↑ Series available on the site official euribor.org[archive].

- ↑ Series available on the site official euribor.org[archive].

- ↑ Series available on the site of INSEE[archive].

- ^ The magazine Challenges in its issue of September 4, 2008, has published a comprehensive article on this subject, the Livret A, term accounts and the super-livrets: competition, which boosted rates.

- b booklet: the Federation critical [archive]

- b S & P considers the livret A "penalizing" for French banks, art[archive]icle of June 21, 2013, on the website of La Tribune.

- r[1]t[archive]icle of June 21, 2013, on the site of the echoes.

- Livret A: Moody's is concerned about the impact on French banks, arti[archive]cle of August 27, 2012, on the website of La Tribune.

- Increase of the ceiling of the booklet has: a shortfall for social security? Publ[archive]ished on submitexpress.com June 14, 2013

- The Bank de France advocates a gradual reform of the livret A [archive]

- ↑ Local: 20 Md€ loan on savings over 5 years article on[archive] the website of the Caisse des dépôts

- ↑ Livret A: why banks are in the fight to deliver on the [archive]site of BFM Business, February 1, 2013

- ^ Article of the further developed online June 21, 2013 [archive]

- The success of the booklet A? Waste! art[archive]icle by Philippe Crevel, published June 4, 2013, on the website of La Tribune.

- ↑ need banks to lend more to the TPE/PME Intervi[archive]ew with the president of the CGPME on zonebourse, 29/01/2010

- ↑ What are more pleasing banks with SMEs? Article[archive] by Challenges from 14 June 2012

- ↑ press release of the Ministry of the economy and and Caisse des dépôts from July 19, 2013 [archive]

See also

Bibliography

- Georges Constantin, the Livret A: A history of the people's savings, Caisse des dépôts and consignations (ISBN 2-911144-05-8) and La Documentation française (ISBN 2-11-004209-5), Paris, 1999, 294 p.

- Séverine de Coninck, the savings booklet (1818-2008). A French passion, Paris, 2012, Economica, 409 p. (ISBN 9782717864328)

External links

- Monetary and financial code (legislative part, book II, title II, chapter I, section 1)

- Report 2012 regulated savings Observatory published by the Bank of France

- The web page of the documentation economy-Finance (CEDAW) Centre devoted to developments in the legislation of the booklet has

- Evolution of the stock of the livret A and other passbooks, on fbf.fr

- Study of Finance & Strategies relating to the cost of the trivialization of the booklet has

- A booklet on service – public.fr

Laisser un commentaire